Originally compiled by Adriana Tullman, Managing Director of Global Investment Solutions at Manna Tree.

Food has proven to be a resilient and steadily growing asset class. Even with factors like inflation and a possible recession, food is a basic human need and not going anywhere- it is however changing. Consumers are recognizing the everyday decisions they make affect their health. Whether it took a global pandemic to shine light on how metabolically unhealthy most of us are (88% in 2019) or the influx of better-for-you options in the supermarket, it’s clear consumers are hopping on the health train. Those who make the switch to a healthier lifestyle rarely go back.

According to McKinsey, wellness is now a $1.5 trillion dollar industry, growing at 5-10% per year. The same study reveals that more than a third of consumers globally are likely to increase spending on wellness. In the United States, over 90% of consumers are seeking healthier food options, and over 65% of consumers are willing to pay a premium for them.

In the healthy food and beverage category, this consumer interest has fueled fragmentation over the past decade, with 980 total financings in the category in 2021 and a 17% 6-year CAGR in the number of financings. As AgFunder reports, “Agrifoodtech is no longer a niche, experimental and risky sector. Median deal-size growth signals maturity of first-wave innovation.”

Today, there are emerging category leaders and the initial stages of defragmentation. As supply chains are strained globally, businesses that have vertical integration or resilience in their supply chain are emerging as leaders. It is an industry in transformation. Ross Iverson, CIO of Manna Tree highlights, “not all innovations are created equal, and consumer adoption to develop sustainable business models is key as you assess who the winners will be in each category.”

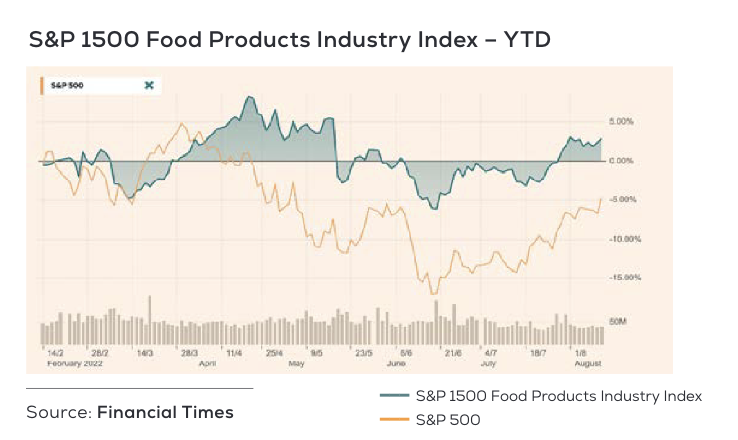

As market conditions shift, access to food and beverage companies provides an uncorrelated defensive asset class where the top line performance benefits from inflationary conditions.The S&P 1500 Food Products Industry Index has outperformed the market year-to-date, up 5% as of August 10, 2022. The food and beverage sector has outperformed the S&P 500, tech, as well as the broader consumer discretionary sector year-to-date.

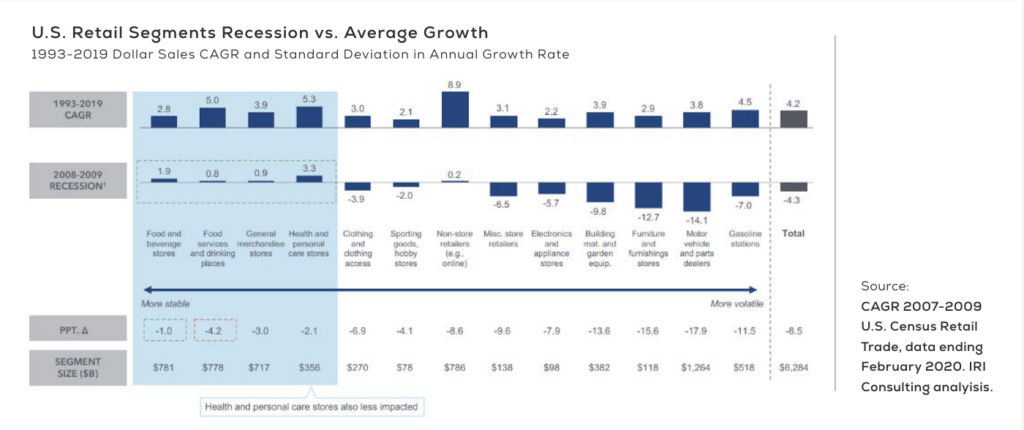

Historically, food and beverage has been a relatively inelastic category through market cycles. In a recent example, food and beverage and health and personal care stores outpaced all other consumer categories during the Great Recession, illustrating the inelastic nature of the category. These categories are the only retail consumer categories with a positive CAGR from 2007-2009.

In private markets, interest in sizable healthy food and beverage businesses from strategic corporate food acquirers remains strong. Food and beverage corporations have strong balance sheets and liquidity. In 2021, the majority of all notable food and beverage transactions were acquisitions by strategic food and beverage companies globally. Financial buyers and public market exits also remain viable exit avenues.

Manna Tree’s CIO, Ross Iverson, says, “Now, more than ever, the modern consumer is investing in their health with their dollar. We believe the defensive nature of the industry, when combined with the strong ESG profile in the better-for-you segment, creates an attractive sector-focused thematic that has the potential to out-perform the current volatile market conditions.”

Past performance is not indicative of future results and there can be no assurance that targeted returns will be achieved. Information and opinions are as of the date of this material only and are subject to change without notice. Originally compiled by Adriana Tullman, Managing Director of Global Investment Services at Manna Tree.

SOURCES:

- UNC on Metabolic Health Study: https://www.unc.edu/posts/2018/11/28/only-12-percent-of-american-adults-are-metabolically-healthy-carolina-study-finds/

- McKinsey.com/industries/consumer-packaged-goods/our-insights/wellness-in-2030

- Next Generation Mindful Consumption, LEK Consulting, October 2018; Fresh Food Consumption is on the Rise, Food Navigator& Deloitte, November 2019

- AgFunder AgriFoodTech Investment Report 2021

- iriworldwide.com/IRI/media/Library/IRI_GrowthConsulting_Building-Brands-in-Recessionary-Periods_April-2020.pdf

- Financial Times – graphs source

- Forbes.com/sites/douglasyu/2022/01/02/recap-of-the-most-important-food-and-beverage-ma-deals-in-2021/?sh=103525d72cf8